1Q18 Market Report

- Canning Properties Group

- Apr 13, 2018

- 4 min read

Updated: Mar 25, 2019

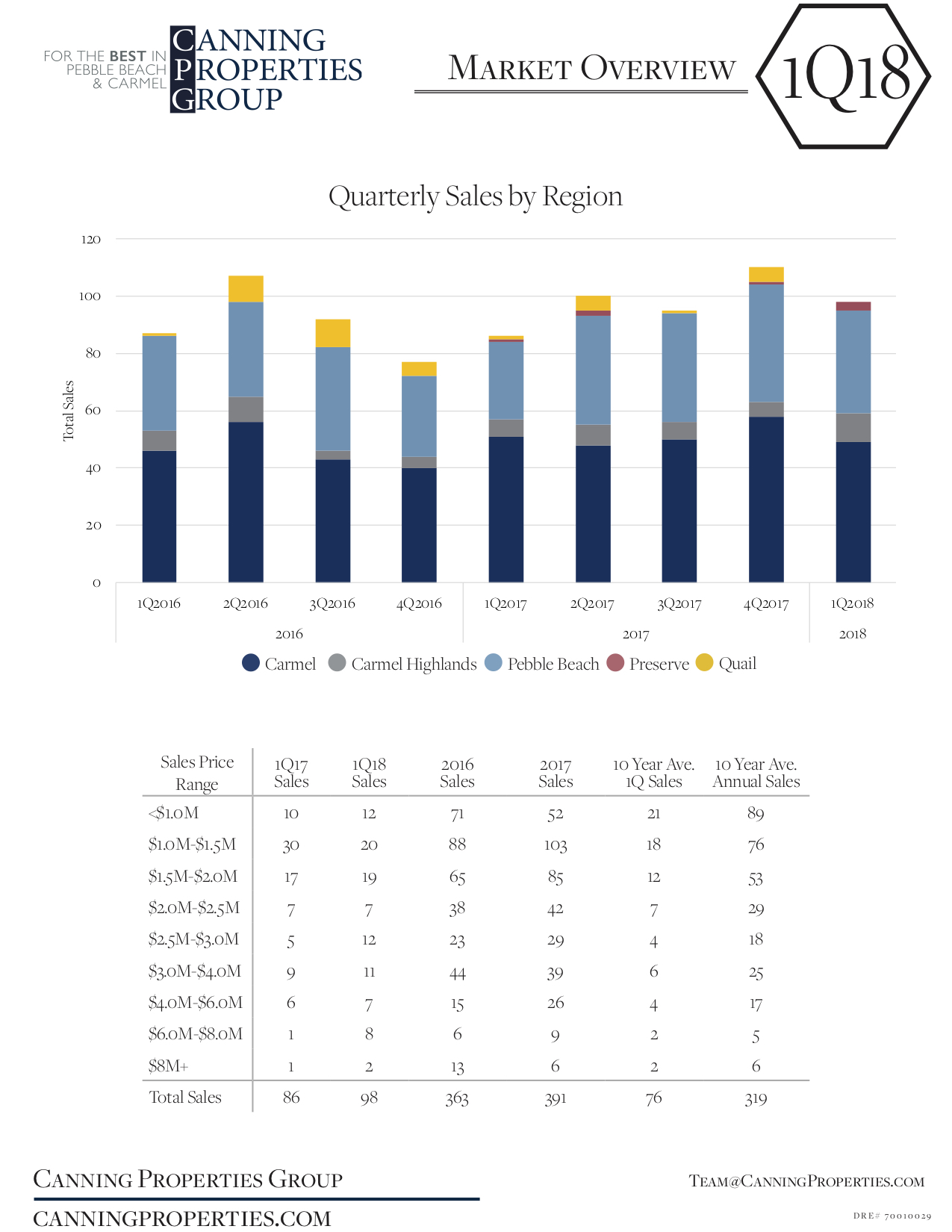

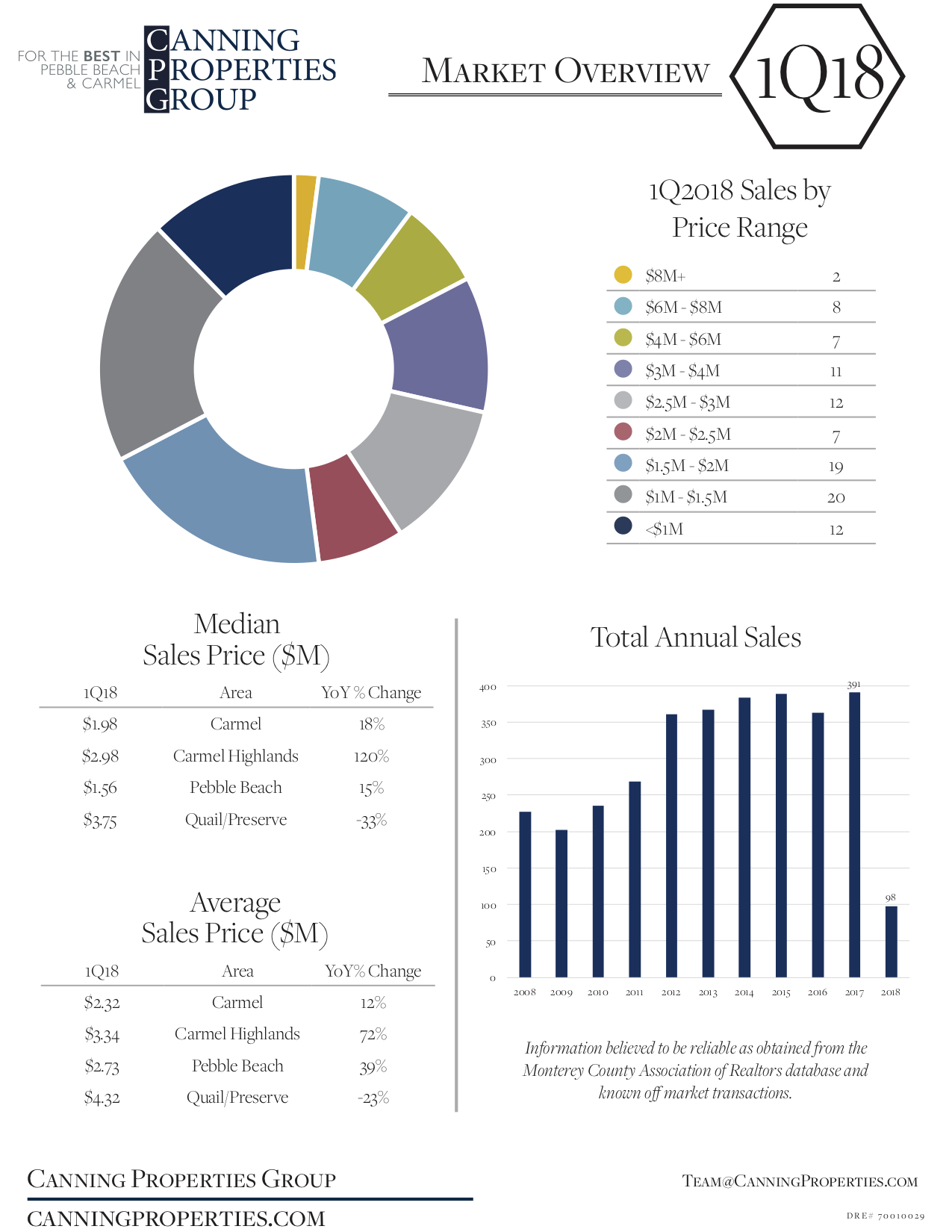

2018 started very strong with 98 closed escrows in Pebble Beach, Carmel, Carmel Highlands, Quail and the Preserve, bringing in a total of $258.3M in sales, which is the highest volume seen in a single quarter in over a decade. Carmel led the pack with nearly $114M in sales, followed by Pebble at $98M. The middle of the market is gaining the most momentum with 23 sales coming between $2.5-4M, representing a 77% increase in activity over last quarter. The top of the market overall is also doing well with 10 sales north of $6M which is the highest level seen in a single quarter in over a decade.

Although all of the regions had a strong quarter, we’re seeing some divergent trends. Fueled by rising prices and tightening inventory, Carmel and Pebble deal-flow were both down compared to last quarter (16% and 12% respectively) whereas the Highlands and Preserve posted standout quarters. Overall median sales price climbed to $1.9M, a jump of 19% over 1Q17. As we enter our prime selling season, we’re seeing an uptick in new listings coming to the market, which should relieve some pressure on prices but given the amount of demand in the market, we anticipate these overall market trends to continue through the summer.

Pebble Beach

Pebble’s market opened 2018 at an energetic pace with 36 closed escrows – although down 10% from an atypically strong 4Q17, still well above 1Q averages (30 sales).

Total dollar volume echoed that trend with an impressive $98.19M (up 54% from 1Q averages) as sales in Pebble’s upper price brackets boosted 1Q dollar volumes.

The $6M-$8M price bracket maintained its robust pace with 3 sales in 1Q and with the prime selling season yet to come, could potentially eclipse ‘17’s record (6 sales).

With 2 closed escrows and 2 pending sales north of $8M thus far in ‘18, the top of the market has also seen an encouraging uptick in activity.

The entry ticket continues to hover above the $1M threshold with just 6 sales below that marker in 1Q – a pace that has slowed since reaching a peak of 59 in 2012.

Pebble’s market continues to favor sellers as demand outpaced supply throughout 1Q, ending the quarter with just 58 active listings (down 7% from 1Q17).

Carmel

Carmel moved at a strong pace this quarter with 49 sales in the key neighborhoods – down slightly from 1Q17 (51 sales), but well above the seasonal average (37 sales). The Golden Rectangle and Carmel Point led the pack with 12 and 11 sales respectively. Although activity has slowed from 4Q17 (58 sales), prices have climbed significantly with the median sales price rising 18% this quarter.

The middle of the market ($2.5M-4M) continues to move quickly with activity surging to 13 sales this quarter, up from 7 last quarter and 9 in 1Q17. For the first time in over a decade, the middle of the market outpaced sales under $1.5M, which fell off this quarter to just 12 – half that of last quarter.

The top of the market has slowed substantially with zero sales over $8M since an off-market house on San Antonio closed for $9.75M last August. Although there have been 12 sales north of $8M in the past 3 years, this is atypical as historically we usually only see 1 sale per year.

Inventory picked up this quarter as we approach our prime selling season with 75 active listings in Carmel, up from just 58 last quarter. However, homes are selling faster with an average days on market of 93, down from last quarter’s 111 days.

Carmel Highlands

The Carmel Highlands kicked off the year with a strong start reporting 10 closed escrows – double that of 4Q17 (5 units) and 40% above the region’s 10-year 1Q average (6 sales).

The floor for the Highlands market continues to climb as sales in 1Q18 were weighted in the higher price brackets with 50% of closings above the $4M mark, and only 1 sale below $1M.

Days on market in the Highlands area continues to be the longest of the regions we cover, averaging 160 days on market for properties sold in 1Q18 (Carmel = 67, Pebble = 145).

Active inventory in the Highlands has reached a 2-year peak with 23 homes and 8 lots currently on the market – up 77% from 1Q17 (14 homes and 4 lots) and 39% from 1Q16 (18 homes and 5 lots).

Total dollar volume thus far in ’18 is ringing in at an impressive $33.43M; compared to a historic 1Q average of $17.71M in the Highlands, the region is on track to outpace previous years.

Quail Lodge/ Preserve

Quail Lodge and Meadows had a quiet quarter with zero closed sales and one condo sale, primarily due to extremely tight inventory (this was the first silent quarter in a decade). However, demand under $4M remains robust- already in 2Q, Quail Lodge had 2 new listings hit the market and went into escrow within 3 days. Demand in the Lodge is currently out pacing Quail Meadows. There’s been a spike on supply in the Meadows – 4 homes now in the market – we’ll be closely monitoring demand there.

The Preserve had a hot start to the year with 3 closed escrows totaling $16.999M – 1 sale behind last year’s total. Also worth noting 16 Vasquez Trail closed at $6.2M- the highest sale price in the Preserve since 2015 and third highest sale overall. Increased velocity is driven by more flexibility in pricing – as the average percentage off list price is at an all-time high of 17.4%.

Houses in the Preserve are moving more quickly than the lots, which had only new sale this quarter. Inventory remains high with 36 active lots on the market with a median list price of $995k – up slightly from the 10 year average sales price of $934K.

Comments