2Q17 Market Update

- Canning Properties Group

- Jul 14, 2017

- 3 min read

Updated: Dec 26, 2018

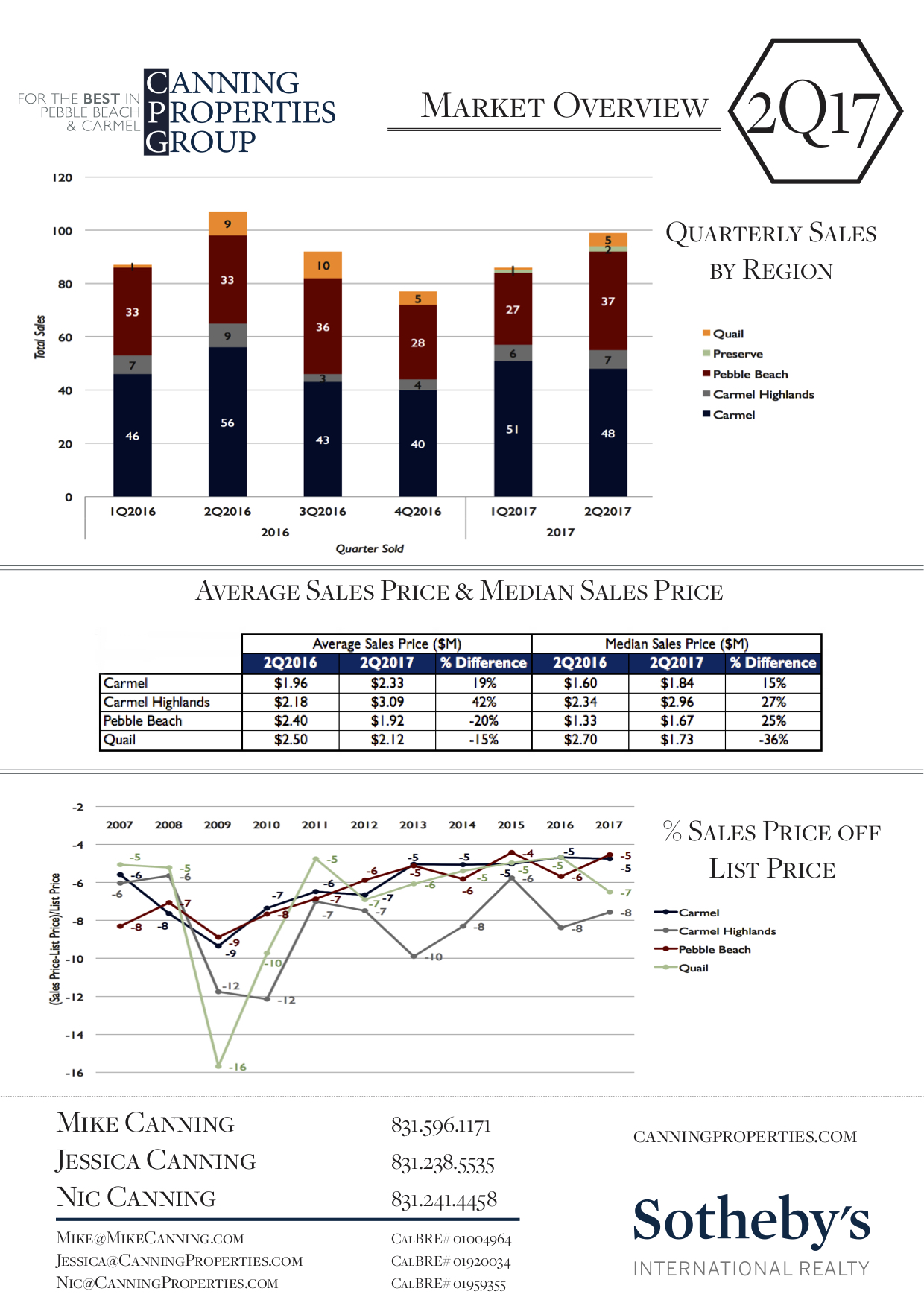

Pebble Beach

Pebble’s market gained momentum in 2Q with 37 sales (up 30% from 1Q), bolstered by a deluge of activity at the bottom of the market (<$2M) that represented 61% of all 2Q’s activity.

The MPCC area was the main beneficiary of the surge with 28 sales (19 under $2M), eclipsing that area’s previous high-water mark of 27 sales set in ’04.

The Upper Forest maintained a healthy pace through 2Q with 6 sales while Central Pebble dipped below its seasonally adjusted averages with just 7 sales.

Inventory levels rose in 2Q to crest the 80+ actively listed marker for the first time in months – up 12% from 1Q as well as the same time last year.

With zero sales north of $6M in 2Q the top of Pebble’s market further saturated, generating just 1 sale above $6M through the first half of ’17.

Worth noting there’s a fair amount in the pipeline already with 19 sales pending and ask prices ranging from $7.995M down to $628K.

Carmel

Following a strong start in ’17, the prime parts of Carmel tapered slightly in 2Q with 48 sales (down 10% from 1Q), but maintained enough momentum to finish above the seasonally adjusted average of 44 sales.

With the slow-down in 2Q, Carmel’s inventory levels have recovered somewhat, rising to 96 actively listed – up 12% from the same time last year.

Northwest (+2), Northeast (+3) and Carmel Point (+5) areas gained ground in 2Q, posting above average total sales, while the Golden Rectangle (-3), Southeast (-1) and Hatton Fields (-5) areas slowed below seasonal norms.

The bottom of Carmel’s market (<$2M) remained strong, representing 70% of all sales as healthy supply-demand ratios propelled activity through the first half. Worth noting that just 4 sales occurred below the $1M threshold (lowest total since ’09) as the entry ticket for Carmel holds firm above $1M.

The $1.5M-$2M and $2-$2.5M price brackets posted their highest 2Q totals since ’00 while just above, the $2.5-$3M and $3-4M brackets stalled – transitioning into one of Carmel’s most saturated brackets (over 25% of active listings).

Carmel Point became a bright spot in 2Q for Carmel’s market, hosting 5 of the 6 closed escrows above $3M and the only 2 sales north of $8M: 26345 Scenic Rd – $10.5M and 26443 Scenic Rd – $8M.

Carmel Highlands

2017 continued at a steady pace in the second quarter with 7 sales, bringing the 2017 total to 13. Although this is down slightly (3 sales) from the first half of 2016, it is almost twice what we saw in the second half of last year (7).

The middle of the market ($2.5-6M) continues to move with 4 of the 7 sales this quarter, including two oceanfront properties.

A lack of supply in Carmel Meadows has slowed activity in that area with just one sale this quarter. Demand remains strong in the Meadows with 5 closed escrows so far this year, already matching all of 2016.

Although the average days on market has held steady for the past couple of years (coming in between 145-151 days on the market), this is still almost double what we’re seeing in Pebble Beach and Carmel (86 and 84 days respectively).

Quail Lodge/ Preserve

Quail had another very strong quarter with 5 closed escrows, up from just 1 last quarter, but slowing from last year when there were 9 closed escrows in the second quarter.

Quail Meadows bounced back with 2 of the closed escrows: 5473 Quail Meadows Drive ($3.75M), we were honored to represent the buyers of this beautiful contemporary home which sold in just 23 days, and 5459 Quail Meadows Drive ($2.619M).

Quail Lodge had three sales this quarter: 7020 Valley Greens Drive #13 ($775K), 8005 River Place ($1.733M) and 7050 Valley Greens Circle ($1.705M).

Demand has been strong in this community with multiple offers coming in for both 5473 Quail Meadows and 8005 River Place

Comments